The clearest takeaway from Permissionless 2022 is that there is no authority in the land of the blockchain. Among any one panel you’d find dissenting opinions on the efficacy of DAOs or how to best reduce friction in the process of onboarding new users of the tech.

We’re at an interesting stage in the development and integration of this technology as we’re watching huge flops in the market and a fear in the public eye over whether or not there’s a future for this stuff.

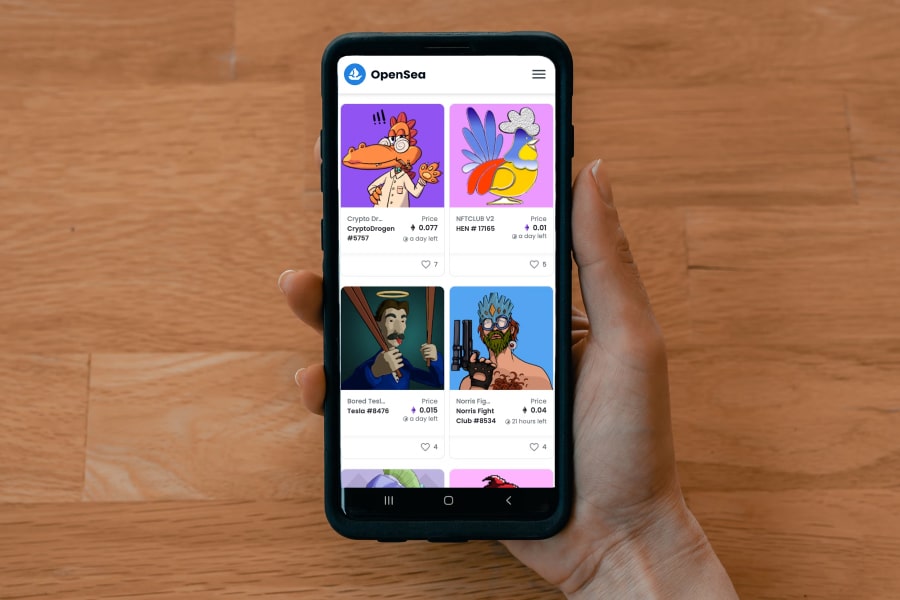

OpenSea, arguably the largest NFT marketplace, reported that over 80% of the content on its platform was fraudulent back in January of this year.

Bored to Death Apes

The speculative nature of cryptocurrency and assets on the blockchain has primarily defined its view in the public eye. The memes around the bored ape NFTs have positioned most people to view NFTs as a fad with no lasting value. Can you blame them?

The financial sector has led the way so far with the development of the tech solely based on their interest in get rich quick schemes. Like the Dotcom boom, a lot of the excitement and energy in this field has revolved around appearance with no concern for functionality.

So Where Is This Heading?

When the bubble burst, 48% of the dot com companies stuck around. Sure, they were pretty banged up, but in time they’d grow to dominate.

If you’re hoping for a list of which companies to look out for in this bubble, I’m sorry to say it’s too early to tell. What I can offer is a list of traits that should help distinguish the genuine innovators from the schemers.

The Sheriff’s In Town: Regulation is Coming to the Wild West

We’ve already seen at the turn of the twentieth century what happens in an unregulated market. People get scammed and promises are left unfulfilled.

While the decentralized nature of the blockchain offers different possibilities, it is the companies who can integrate the tech into safe and regulated spaces that will thrive in the coming years.

Merge Onto The Highway of Behavior Already Happening

During the panel “Gaming: The Trojan Horse of the Metaverse”, Angela Dalton of Signum Growth Capital talked about the approach of “merging onto the highway of behavior already happening”.

She was referencing the adoption of NFTs in gaming not for some wild idea that assets from one game would be transferable into any other but that ownership of digital assets is something that gamers have already been involved with for some time.

It may sound like common sense but companies that can enhance the experience of behavior already practiced rather than promising the massive onboarding of entirely new behavior have the right idea.

Building On Foundation: Integration With Pre-Existing Institutions is Key

This last point that I can’t stress enough is that any company promising to entirely break free from the “chains of old money and bureaucracy” is blowing smoke up your ass.

Web 3.0, just like Web 2.0, will find its legs by enhancing, facilitating, and simplifying payments and interactions between businesses and consumers. Most people are not going to go through the hassle of creating a digital wallet and purchasing some unstable cryptocoin to use an app that only has value based on how many other users agree it does.

The companies that understand the tech and can find practical solutions it can offer to names that people trust will be the leading figures in defining what Web 3.0 will actually look like.